The Real Deal—For Real

“We’re not getting high inflation anytime soon. In fact, we’re looking at a deflationary bust. So, gold isn’t going up.”

So said one of my smarty pants colleagues back in the aftermath of the GFC (Global Financial Crisis circa 2008) in one of our asset allocation meetings. We’d been long gold and gold mining stocks and were trying to figure out what would happen next. The group consisted of mainly security selection experts in their own asset class who didn’t much about asset allocation. (It wasn’t until later that I successfully booted them out and made asset allocation a unique discipline, not an afterthought.)

Well he was right about the deflation part, but wrong about gold, at least for a few more years. As we continued to see new highs in gold during that period people in the group pontificated – “it’s because of the dollar”, “it’s because of QE”, “no it’ really because of deflation.” Frustrated at all this theorizing without any empirical data, we ran a study on what does drive gold prices. And as most of you have been yelling at your screens while reading this, it’s all about real rates.

No one has beaten gold

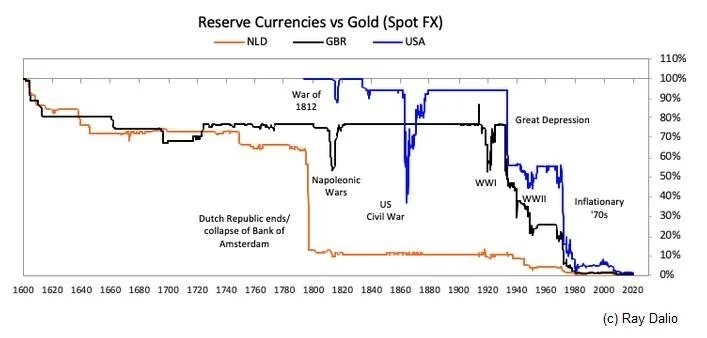

The actual inflation level doesn’t really matter. Neither does the strengthening or weakening value of dollar. No. These factors can be transitory and not all always present in a sustainable move on gold. So, therefore, I consider them coincidental or symptoms of something else lurking underneath. And that something else is Real Rates. Basically, the question we have to ask ourselves is: once you account for inflation, then is my money gaining value or losing value? With declining real rates, the value of that money is declining. Gold, then can be the alternative currency that has historically proven to hold its value in the face of declined real fiat currency value. Guess we should’ve just Googled the question back then, but we wanted to research it ourselves.

Ever since the crisis started in February 2020, nominal rates have been bumping along the low end of their historical range, while inflations, still at low levels, has been higher than those nominal rates, leading to declining and now negative real rates. So it’s no surprise that gold has been on a tear since the initial drop in the depth of the market crisis. That drop can be attributed to technical deleveraging and a sudden and enormous drop in inflation expectations.

Negative real rates basically tell us that the central bank is running monetary policy too loosely for where the rates market expects it to be given the level of inflation. Well that ain’t no surprise here. You’d have to be a reality TV character to not know that the Fed is pedal to the metal on keeping the money spigots going.

And with all the money printing coming down and still expected to come in order to fund those deficits and monetize that mountain of debt. Couple that with the Fed’s willingness to be like drunken sailors with rates, inflation will be allowed will be allowed to bubble up above nominal rates.